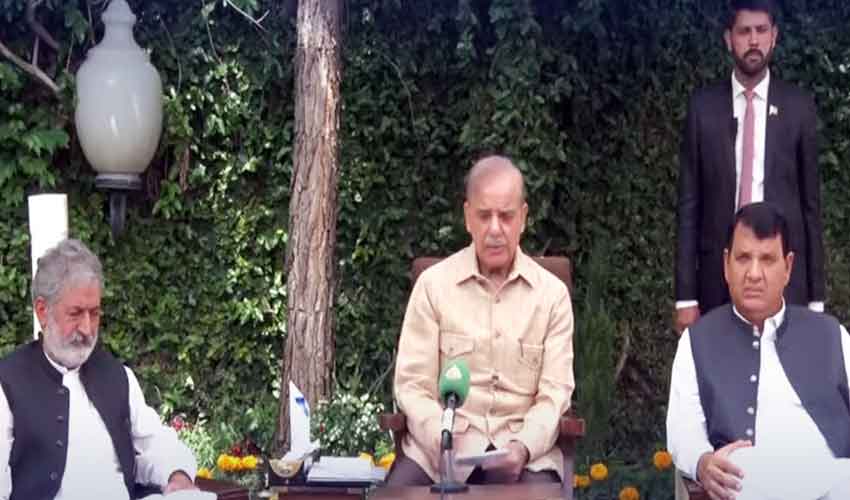

PM thanks army chief Gen Asim Munir for helping eliminate smuggling

Shehbaz says economy cannot be strengthened without ending smuggling

Shehbaz says economy cannot be strengthened without ending smuggling

Since Ayesha's health is stable, she is free to go back to Pakistan

Senate is symbol of federation: Sherry Rehman

International per barrel prices stand at $104.76 for diesel and $107.16 for petrol

Steady trend reflects current financial landscape, providing sense of assurance to those closely following currency dynamic

Jacen Russell-Rowe sealed victory for Columbus

'Efforts are underway to spread unrest in party', says Marwat

Judge refrains media from publishing provocative statements against political figures, institutions

This battery is suitable for usage in smartphones as well as electric vehicles

Shehbaz says economy cannot be strengthened without ending smuggling

Shehbaz asks businessmen to treat upcoming Saudi investors delegation to nihari, kababs

Court annuls ECP decision to order re-election at 12 polling stations of PB-51 Chaman constituency

Pakistan Autism Society says there are approximately 350,000 children suffering from autism disorder in country

Virtual gaming takes center stage as Pakistan hosts esports championships

A case has been registered against the accused and the investigation is underway.

International per barrel prices stand at $104.76 for diesel and $107.16 for petrol

Jacen Russell-Rowe sealed victory for Columbus

Shehbaz asks businessmen to treat upcoming Saudi investors delegation to nihari, kababs

This battery is suitable for usage in smartphones as well as electric vehicles

It is the most recent confrontation between the police and students, who are angry over large number of people dying in Israel's war with Hamas

Since Ayesha's health is stable, she is free to go back to Pakistan

Study discovers that sound coming from a disturbed plant could be heard over a meter away

Implementing reporting standards 18 has its challenges, but offers long-term benefits