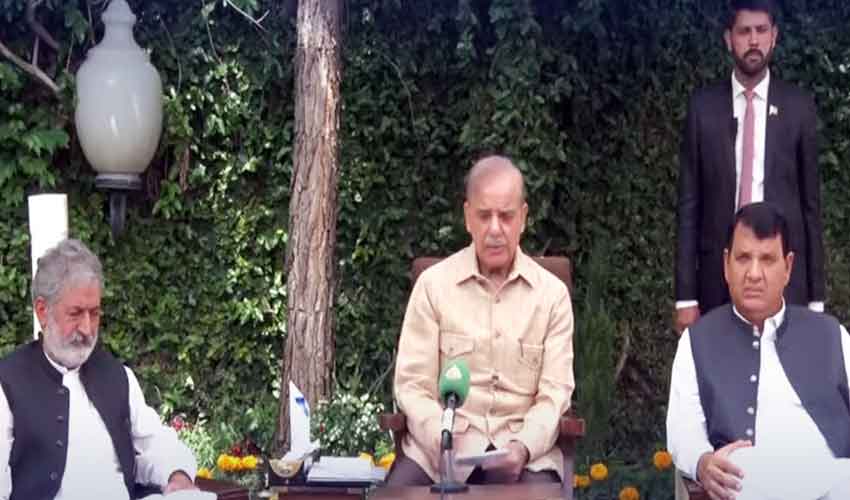

PM thanks army chief Gen Asim Munir for helping eliminate smuggling

Shehbaz says economy cannot be strengthened without ending smuggling

Shehbaz says economy cannot be strengthened without ending smuggling

'Establishment of nutrition force topmost priority of Punjab CM', says minister

This year, four hundred children of laborers will study in higher educational institutions in Pakistan, CM

Lahore remains cloudy with minimal chances of rain

The air ambulance service will be expanded throughout Punjab, Maryam Nawaz

People face difficulty to reach office due to long queues of vehicles.

Educational vsit to Lahore Garrison and Wagah Border leaves lasting impression

Chinese conglomerate's investment in coal projects to tackle energy crisis

The rights of women and transgender community will be discussed

Shehbaz says economy cannot be strengthened without ending smuggling

Read all facilities to be provided in the Karachi cattle market

Court annuls ECP decision to order re-election at 12 polling stations of PB-51 Chaman constituency

Pakistan Autism Society says there are approximately 350,000 children suffering from autism disorder in country

Jacen Russell-Rowe sealed victory for Columbus

A case has been registered against the accused and the investigation is underway.

Chinese conglomerate's investment in coal projects to tackle energy crisis

Cristiano Ronaldo treats fans to snapshots of blissful moments spent with Georgina

Prince William shares glimpses of the inspiring mental health project in action

Tech giant is poised to elevate consumer experience by bringing cutting-edge AI capabilities directly to its devices

Lack of progress sparks worries over terrorism and stability

'Establishment of nutrition force topmost priority of Punjab CM', says minister

Owner attributes her unusual colouration to biliverdin, benign bile pigment encountered in womb

Implementing reporting standards 18 has its challenges, but offers long-term benefits