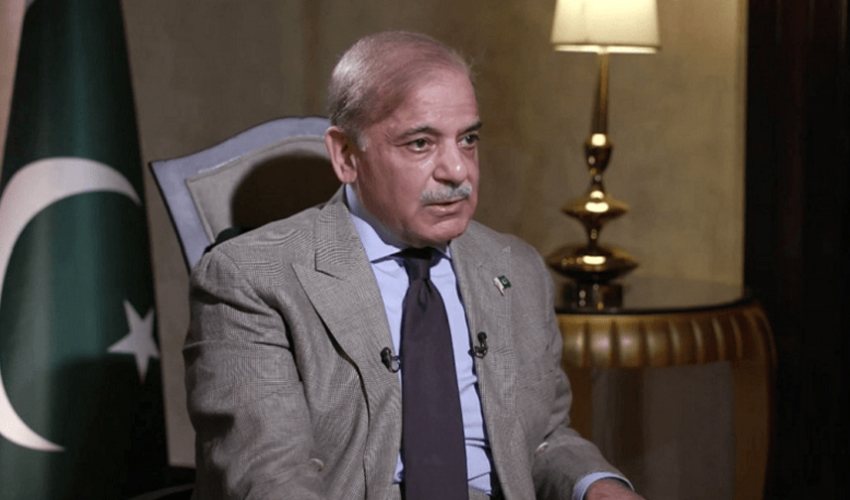

Training Saudi pilots agreed at World Economic Forum: PM Shehbaz

Credits Crown Prince Mohammed bin Salman with transforming Saudi Arabia’s landscape; hails his policies as an inspiration for leaders worldwide

Credits Crown Prince Mohammed bin Salman with transforming Saudi Arabia’s landscape; hails his policies as an inspiration for leaders worldwide

China experienced a steady increase in international tourist arrivals

Bilawal says 'TikTokers replace political workers'

Price of a 5-kilowatt solar system notably decreased to Rs 2,15,000

Australia also recognizes scores from other established English proficiency exams

Directs Punjab government takes proactive measures to mitigate effects of severe weather

Move aims to promote private sector growth and competition, improve economic health

Mother and three children were killed on the spot

The vote also recognizes Palestine's right to become the 194th member of the body

Credits Crown Prince Mohammed bin Salman with transforming Saudi Arabia’s landscape; hails his policies as an inspiration for leaders worldwide

Anthony, resident of Kot Khawaja Saeed in Lahore, travelled to Portugal from Sweden to work on degree project

Sardar Saleem becomes 39th governor of Punjab

Bureau also explores option of imposing 2.5% additional withholding tax on mobile phone usage by non-filers

Judge says male students may start gathering outside girls' colleges if given bikes

Protest attracts hundreds of activists

Price of a 5-kilowatt solar system notably decreased to Rs 2,15,000

Skipper Babar Azam scored 57 runs during the innings

Australia also recognizes scores from other established English proficiency exams

Protest attracts hundreds of activists

China experienced a steady increase in international tourist arrivals

CM Maryam vows to increase doctors, paramedic staff

After a few bites, female customer felt the paneer was harder than usual.

Effects of inflation are far-reaching, influencing various sectors of the economy