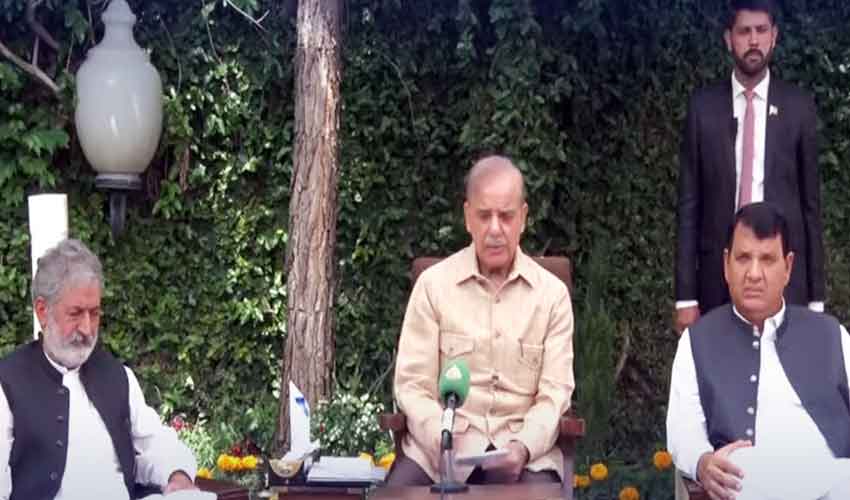

PM thanks army chief Gen Asim Munir for helping eliminate smuggling

Shehbaz says economy cannot be strengthened without ending smuggling

Shehbaz says economy cannot be strengthened without ending smuggling

The rights of women and transgender community will be discussed

Court adjourns hearing in case until April 29

Inspiring journey of a young Hindu officer breaking barriers in Pakistan military

Lack of progress sparks worries over terrorism and stability

Concerns mount as Indian Muslims fear marginalization under Modi administration

Unemployment soars despite govt efforts, raising concerns about social unrest

Cristiano Ronaldo treats fans to snapshots of blissful moments spent with Georgina

Spox highlights report's failure to address grave humanitarian issues such as the situation in Gaza, IIOJK

Shehbaz says economy cannot be strengthened without ending smuggling

Read all facilities to be provided in the Karachi cattle market

Court annuls ECP decision to order re-election at 12 polling stations of PB-51 Chaman constituency

Pakistan Autism Society says there are approximately 350,000 children suffering from autism disorder in country

Jacen Russell-Rowe sealed victory for Columbus

A case has been registered against the accused and the investigation is underway.

Gross domestic product increased at a 1.6% annualized rate last quarter

Cristiano Ronaldo treats fans to snapshots of blissful moments spent with Georgina

Prince William shares glimpses of the inspiring mental health project in action

Tech giant is poised to elevate consumer experience by bringing cutting-edge AI capabilities directly to its devices

Lack of progress sparks worries over terrorism and stability

Since Ayesha's health is stable, she is free to go back to Pakistan

Owner attributes her unusual colouration to biliverdin, benign bile pigment encountered in womb

Implementing reporting standards 18 has its challenges, but offers long-term benefits